A conference titled “VAT Law Enforcement and Problems Faced by Entrepreneurs” was held last week by the Mongolian People’s Party (MPP), entrepreneurs and NGOs.

The Mongolian Wool and Cashmere Association and Mongolian Food Producers’ Association attended the conference.

During the conference, representatives from NGOs stressed that the new VAT Law was “strangling” businesses and that it’s causing them to close down. In response, MPP members said that they would discuss it with their party and find a solution.

The revised VAT Law created a new reward system that gives taxpayers the opportunity to win money from a monthly lottery. Entrepreneurs claim that the new reward system is causing losses to businesses as people now choose to purchase products and receive services from businesses that give receipts.

WHAT IS VAT?

VAT, value-added tax, is a tax levied on final consumption. In other words, people pay taxes for using and purchasing a product. Commerce and service businesses, on the other hand, are obliged to collect people’s taxes and centralize it to the state budget. Any business with an annual turnover of 50 million MNT or more are registered as a VAT payer in accordance with the law.

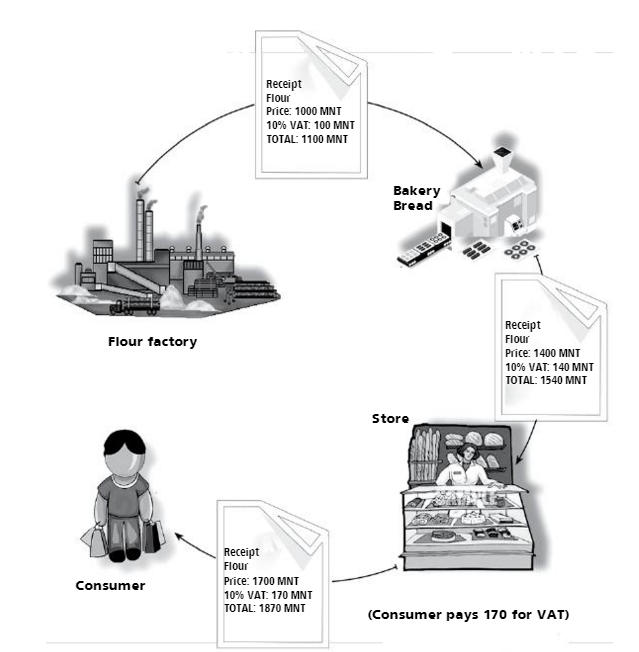

Let’s take a look at how VAT is collected using stages: flour factories, bakeries, stores and consumer.

A factory sets a price of 1,000 MNT per kg of flour, but sells it to a bakery for 1,100 MT after adding 100 MNT as VAT. It costs 1,400 MNT for the bakery to make a bread with the flour. The bakery adds 10 percent of the cost as VAT and supplies it to stores for 1,540 MNT. Finally, stores sell bread to consumers for 1,870 MNT. The total VAT paid to the state budget from bread amounts to 170 MNT: 100 MNT paid by the factory, 40 MNT paid by the bakery, and 30 MNT by the store. You might be wondering why the bakery paid only 40 MNT in VAT. This is because the 100 MNT tax imposed when purchasing the flour for 1,100 MNT is deducted, leaving 40 MNT to go straight to the state.

The flour factory, bakery and store don’t pay the bread’s 170 MNT VAT. Instead, the customer pays all of it when they buy bread. In this case, VAT burdens residents rather than entrepreneurs.

VAT collection process[/caption]

HOW IS VAT LAW STRANGLING BUSINESSES?

Theisn’t something new that became effective this year. Mongolia already enacted this law and its revised version became effective from the beginning of 2016.

The main change in the VAT Law is the new reward system for taxpayers besides income registration of entities, as pointed out by the General Customs and Taxation Office. Unlike the old system, the new reward system enables taxpayers to cash back 20 percent of the tax they paid at the end of each year. This is viewed as a support to the public rather than a burden during the current economic difficulty. It can be said that the amount of VAT charged has actually dropped from 10 percent to eight percent.

Some people were against the new VAT Law when it was first proposed because they believed that the state was trying to record the public’s income. State Inspector of the General Customs and Taxation Office S.Munkhtuul commented on this.

“We’re not recording people’s income. The law doesn’t specify each person to register only their own receipts. They can register receipts of purchases made by their family or relatives from a single account. People’s data will be used for statistical purposes only,” she says.

President of the National Chamber of Commerce and Industry B.Lkhagvajav spoke about the new reward system during a press conference.

“The public will get the opportunity to get prizes with the launching of the new VAT Law. Businesses need to meet technological conditions, or they will drop in their overall competitiveness in the market,” said B.Lkhagvajav.

NGOs and entrepreneurs at the “VAT Law Implement and Problems Faced by Entrepreneurs” conference stated that the public now prefer stores and businesses that give receipts for their purchase. As explained, customers can get back 20 percent of the VAT they paid as well as get a chance to win a prize from the monthly lottery with the code on receipts. Entrepreneurs were certain that revenue of entities that don’t hand out receipts will decrease and blamed it on the VAT Law.

However, the Law on Taxes states that it is mandatory for any individual or company running a business to have a standard cash register. Businesses can expand operations if they follow the law and enable customers to get their rightful benefits.

The government projected that the state budget revenue will increase by 140 billion MNT by implementing the revised VAT Law. This doesn’t mean that extra tax will be imposed on the public and businesses. Instead, more tax revenue will be centralized to the state budget because the tax collection process will become more transparent and there will not be any loopholes allowing businesses to embezzle or launder taxpayers’ money. Receipts have become a way to record the amount of tax paid by the public and guarantees that the money has gone to the state.

Financial statements and reports of January and February 2016 show that incomes of businesses are higher than last year’s income. Reportedly, the amount of VAT paid to the state budget has increased since the revised VAT Law became effective. Experts explain that more transparency in the taxation system led to the increase. This implies that businesses used to embezzle VAT in the past.

Overall, analysts believe that the new VAT Law isn’t strangling businesses. Entrepreneurs only need to follow the law and purchase a cash register. That way, they will not lose customers and might even help a customer win a lottery prize.

VAT collection process[/caption]

HOW IS VAT LAW STRANGLING BUSINESSES?

Theisn’t something new that became effective this year. Mongolia already enacted this law and its revised version became effective from the beginning of 2016.

The main change in the VAT Law is the new reward system for taxpayers besides income registration of entities, as pointed out by the General Customs and Taxation Office. Unlike the old system, the new reward system enables taxpayers to cash back 20 percent of the tax they paid at the end of each year. This is viewed as a support to the public rather than a burden during the current economic difficulty. It can be said that the amount of VAT charged has actually dropped from 10 percent to eight percent.

Some people were against the new VAT Law when it was first proposed because they believed that the state was trying to record the public’s income. State Inspector of the General Customs and Taxation Office S.Munkhtuul commented on this.

“We’re not recording people’s income. The law doesn’t specify each person to register only their own receipts. They can register receipts of purchases made by their family or relatives from a single account. People’s data will be used for statistical purposes only,” she says.

President of the National Chamber of Commerce and Industry B.Lkhagvajav spoke about the new reward system during a press conference.

“The public will get the opportunity to get prizes with the launching of the new VAT Law. Businesses need to meet technological conditions, or they will drop in their overall competitiveness in the market,” said B.Lkhagvajav.

NGOs and entrepreneurs at the “VAT Law Implement and Problems Faced by Entrepreneurs” conference stated that the public now prefer stores and businesses that give receipts for their purchase. As explained, customers can get back 20 percent of the VAT they paid as well as get a chance to win a prize from the monthly lottery with the code on receipts. Entrepreneurs were certain that revenue of entities that don’t hand out receipts will decrease and blamed it on the VAT Law.

However, the Law on Taxes states that it is mandatory for any individual or company running a business to have a standard cash register. Businesses can expand operations if they follow the law and enable customers to get their rightful benefits.

The government projected that the state budget revenue will increase by 140 billion MNT by implementing the revised VAT Law. This doesn’t mean that extra tax will be imposed on the public and businesses. Instead, more tax revenue will be centralized to the state budget because the tax collection process will become more transparent and there will not be any loopholes allowing businesses to embezzle or launder taxpayers’ money. Receipts have become a way to record the amount of tax paid by the public and guarantees that the money has gone to the state.

Financial statements and reports of January and February 2016 show that incomes of businesses are higher than last year’s income. Reportedly, the amount of VAT paid to the state budget has increased since the revised VAT Law became effective. Experts explain that more transparency in the taxation system led to the increase. This implies that businesses used to embezzle VAT in the past.

Overall, analysts believe that the new VAT Law isn’t strangling businesses. Entrepreneurs only need to follow the law and purchase a cash register. That way, they will not lose customers and might even help a customer win a lottery prize.

VAT collection process[/caption]

HOW IS VAT LAW STRANGLING BUSINESSES?

Theisn’t something new that became effective this year. Mongolia already enacted this law and its revised version became effective from the beginning of 2016.

The main change in the VAT Law is the new reward system for taxpayers besides income registration of entities, as pointed out by the General Customs and Taxation Office. Unlike the old system, the new reward system enables taxpayers to cash back 20 percent of the tax they paid at the end of each year. This is viewed as a support to the public rather than a burden during the current economic difficulty. It can be said that the amount of VAT charged has actually dropped from 10 percent to eight percent.

Some people were against the new VAT Law when it was first proposed because they believed that the state was trying to record the public’s income. State Inspector of the General Customs and Taxation Office S.Munkhtuul commented on this.

“We’re not recording people’s income. The law doesn’t specify each person to register only their own receipts. They can register receipts of purchases made by their family or relatives from a single account. People’s data will be used for statistical purposes only,” she says.

President of the National Chamber of Commerce and Industry B.Lkhagvajav spoke about the new reward system during a press conference.

“The public will get the opportunity to get prizes with the launching of the new VAT Law. Businesses need to meet technological conditions, or they will drop in their overall competitiveness in the market,” said B.Lkhagvajav.

NGOs and entrepreneurs at the “VAT Law Implement and Problems Faced by Entrepreneurs” conference stated that the public now prefer stores and businesses that give receipts for their purchase. As explained, customers can get back 20 percent of the VAT they paid as well as get a chance to win a prize from the monthly lottery with the code on receipts. Entrepreneurs were certain that revenue of entities that don’t hand out receipts will decrease and blamed it on the VAT Law.

However, the Law on Taxes states that it is mandatory for any individual or company running a business to have a standard cash register. Businesses can expand operations if they follow the law and enable customers to get their rightful benefits.

The government projected that the state budget revenue will increase by 140 billion MNT by implementing the revised VAT Law. This doesn’t mean that extra tax will be imposed on the public and businesses. Instead, more tax revenue will be centralized to the state budget because the tax collection process will become more transparent and there will not be any loopholes allowing businesses to embezzle or launder taxpayers’ money. Receipts have become a way to record the amount of tax paid by the public and guarantees that the money has gone to the state.

Financial statements and reports of January and February 2016 show that incomes of businesses are higher than last year’s income. Reportedly, the amount of VAT paid to the state budget has increased since the revised VAT Law became effective. Experts explain that more transparency in the taxation system led to the increase. This implies that businesses used to embezzle VAT in the past.

Overall, analysts believe that the new VAT Law isn’t strangling businesses. Entrepreneurs only need to follow the law and purchase a cash register. That way, they will not lose customers and might even help a customer win a lottery prize.